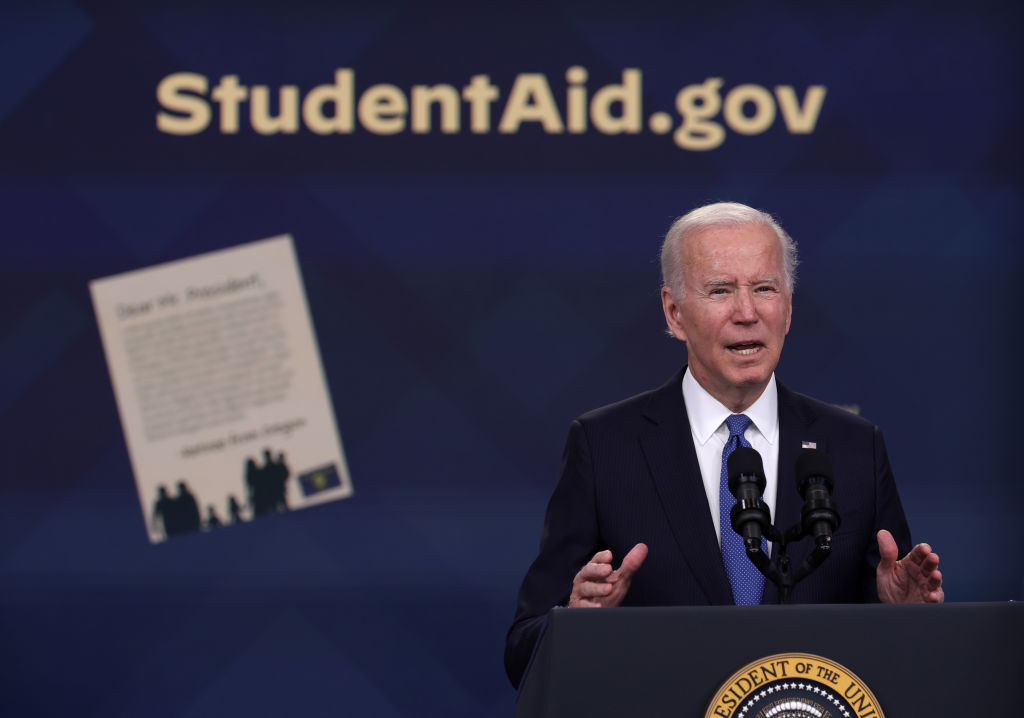

President Joe Biden speaks on the student debt relief plan in the South Court Auditorium at the Eisenhower Executive Office Building on October 17, 2022, in Washington, D.C. | Source: Alex Wong / Getty

When the Biden administration announced in August 2022 that it was canceling up to $20,000 in student loan debt per borrower, it said the idea was to provide families with “breathing room as they prepare to start repaying loans after the economic crisis brought on by the pandemic.” But two federal courts recently blocked President Joe Biden’s student loan relief program, ruling it unconstitutional. Here, William Chittenden, a professor of finance at Texas State University, explains why and what’s next for student loan borrowers still hopeful that their loans can be forgiven.

1. Why was Biden’s student loan cancellation program blocked?

It was found to be unconstitutional. That determination was made on Nov. 10, 2022, by Judge Mark Pittman of the U.S. District Court of Northern Texas, who ruled that the Higher Education Relief Opportunities for Students Act of 2003 – or Heroes Act – “does not provide the executive branch clear congressional authorization” for a student loan forgiveness program. He said further that the program was “an unconstitutional exercise of Congress’s legislative power and must be vacated.”

The judge’s ruling prevents any student loans from being forgiven “until a final verdict is made” in the case. Technically it could go to the Supreme Court, but it may also be settled at the appellate court level.

In a separate case, on Nov. 14, a three-judge panel with the United States Court of Appeals for the 8th Circuit temporarily blocked the program until the case is resolved in court. The 8th Circuit covers seven states, including Missouri, which is one of several Republican-led states seeking to block the program.

Both rulings effectively block Biden’s plan to forgive up to $20,000 in student loans per borrower.

2. Can it be unblocked?

Both court decisions could be reversed. The Biden administration has argued that the Heroes Act of 2003 allows the Secretary of Education to forgive student loans for those affected by the pandemic.

The Biden administration has already filed a notice to appeal the Nov. 10 ruling by Pittman.

On Nov, 18, the Biden administration asked the Supreme Court to vacate the order by the Court of Appeals blocking student loan forgiveness. The Supreme Court has asked the plaintiffs in the case to provide their response by Nov. 23, 2022.

It is unclear how the full court might rule. However, in two previous instances, Justice Amy Coney Barrett has shot down attempts to block the student loan forgiveness plan.

3. What kind of relief can student loan borrowers get in the meantime?

Currently, student loan payments are paused but are scheduled to start again – either 60 days after the legal cases against the program have been resolved, or 60 days after June 30, 2023, whichever comes first. The Biden administration could extend the payment pause beyond December 2022. However, in August 2022 – when the most recent payment pause extension was announced – the White House stated that it was supposed to be the final extension.

Despite the setback for widespread student loan forgiveness, some borrowers may still qualify for one or more targeted student loan forgiveness programs. These groups include borrowers who attended a school that shut down. Student loans may also be forgiven for those who are totally and permanently disabled. Students who were defrauded by their school – such as by being misled about job placement rates for graduates or the true cost to attend the school – may also be eligible.

In November 2022, the Biden administration released new rules to make it easier for student loans to be discharged in bankruptcy. If a student loan borrower can prove their expenses are equal to or greater than their income, the student loan debt may qualify to be eliminated in bankruptcy.

William Chittenden, Associate Professor of Finance, Texas State University

This article is republished from The Conversation under a Creative Commons license. Read the original article.

![]()

SEE ALSO:

Republicans Want Biden To Reverse The $10,000 Student Debt Cancellation, But We Are Fighting Back

The post The State Of Student Debt Cancellation Now That Courts Blocked It: What’s Next? appeared first on NewsOne.